Since new Accessory Dwelling Unit laws have come into effect across the West Coast, we have witnessed just how much value a well-planned ADU can add to your property. The Cottage team has compiled this guide to help you understand the potential value an ADU can add to your home.

Does an ADU Add Value to Your Home?

Yes! Much like other home-improvement projects, the addition of an ADU can add considerable value to your home. As we dove deeper into recent sales of homes with ADUs, we uncovered a secret hiding in plain sight: building an ADU can unlock hundreds of thousands of dollars of property value.

Given that property prices in California are among the highest in the country, homeowners can capitalize on this by adding an ADU and boosting their ROI.

As one realtor told one of Cottage's homeowners who was considering building an ADU, "‘This is a no brainer. It’s like printing money - go ahead and build it.'" Another real estate broker and investor Cottage spoke with asserted that "ADU’s allow you to cash flow real estate.”

Let’s dive into a few local examples that show how you can build your ADU for less than its completed value. With all-in design-build costs in the $350-500 per square foot range and home sale prices often stretching to $800/sq. ft. and beyond, adding an ADU can have a high return on investment!

One note before we continue—with the limited number of properties with ADUs that have hit the market thus far, this is an early attempt to assess how much adding an ADU can impact the potential sale price. While this does not guarantee the ultimate value* for your ADU project, we will be eagerly following this trend as more and more homes are sold with ADUs.

Ready to unlock your property’s potential with a custom ADU? Click here to book a free consultation and estimate with a Cottage ADU expert!

How Much Does an ADU Add to Property Value?

The exact value addition depends on a number of factors, such as ADU purpose, size, type, and location. That being said, ADUs can add anywhere from $200,000-$500,000 to a California home’s property value in the short term. In the longer term, these numbers can be greater as property appreciates in value over time.

How Does an ADU Add Value to Your Home?

ADUs bring many financial and social benefits. Not only do they make your property more attractive to buyers, but they are an incredibly versatile and practical solution to affordable housing. Here are a few different ways ADUs add financial and social value to your property in both the short- and long-term:

- Property resale value increases by roughly 30% depending on size and location

- Homeowners can make passive income through rent, and earn back the cost of the project

- Brings a great return on investment

- Allows for intergenerational housing so elderly residents can age in place

- Allows older children and young adults to live independently

ADUs can serve many purposes and bring great value to homeowners based on the specifics of the project. Keep reading to learn how.

Factors That Determine ADU Value Addition

The exact value an ADU will add to your home depends on the following factors:

Current property value

If your home is currently valued at $600,000, you can expect the addition of an ADU to increase its value by roughly $180,000, or 30%. Such valuations are to be expected for larger ADUs with bigger budgets, so this number can vary depending on size.

ADU type and size

Some ADU types are more spacious than others, and square footage indicates how much value an ADU will add to your property. Using the value per square foot of your current home, you can estimate the added value of your ADU with this simple equation:

(Current value/sq. ft.) x sq. ft. of proposed ADU

ADU build quality and features

The value an ADU brings to your home also depends on the specifics of the project. There is hidden value in the details, such as if you’ve used high-quality materials and unique fittings, or have spacious and aesthetically designed living areas.

Local housing market

Meeting market demands can add significant value to your home. What are local buyers looking for? Home offices, sauna rooms, and other niche spaces may make your ADU more desirable to buyers and increase your property value.

The value of your ADU and the scope of your project would determine the cost of permitting and other fees. When you look at the bigger picture however, it’s clear that an ADU is a worthwhile investment, and you’ll likely earn back the cost of your project within a few short years.

The factors we covered above are not exhaustive, but they can give you a general idea of what to expect. Having said that, the biggest indicator of value is the type of ADU you are building, so let’s look at that next.

How do Different ADU Types Add Value to Your Home?

Detached ADUs that are separate from the primary dwelling have the potential to add the most value to your property. The next highest value addition would be an attached ADU, followed by a conversion ADU. Here’s how:

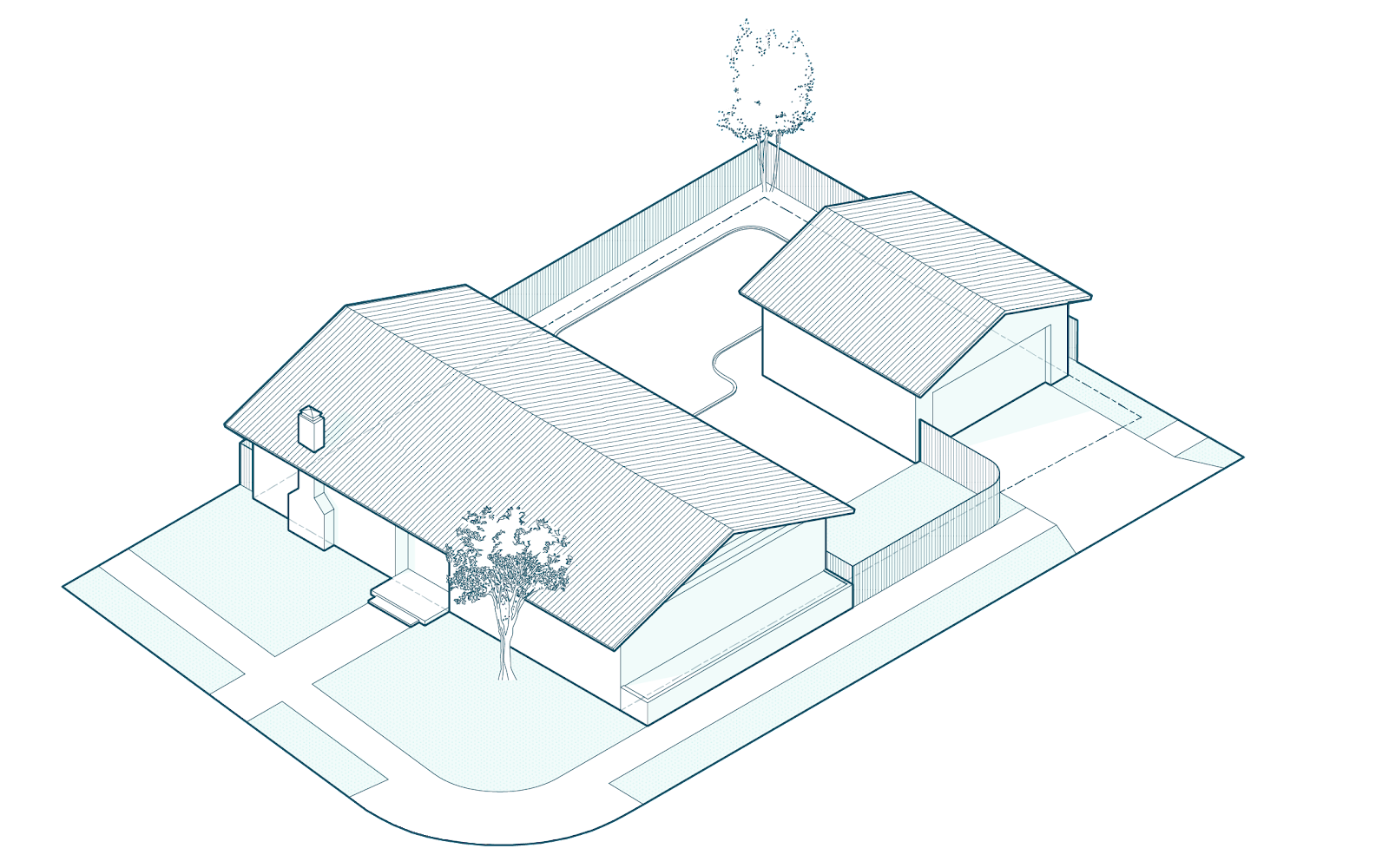

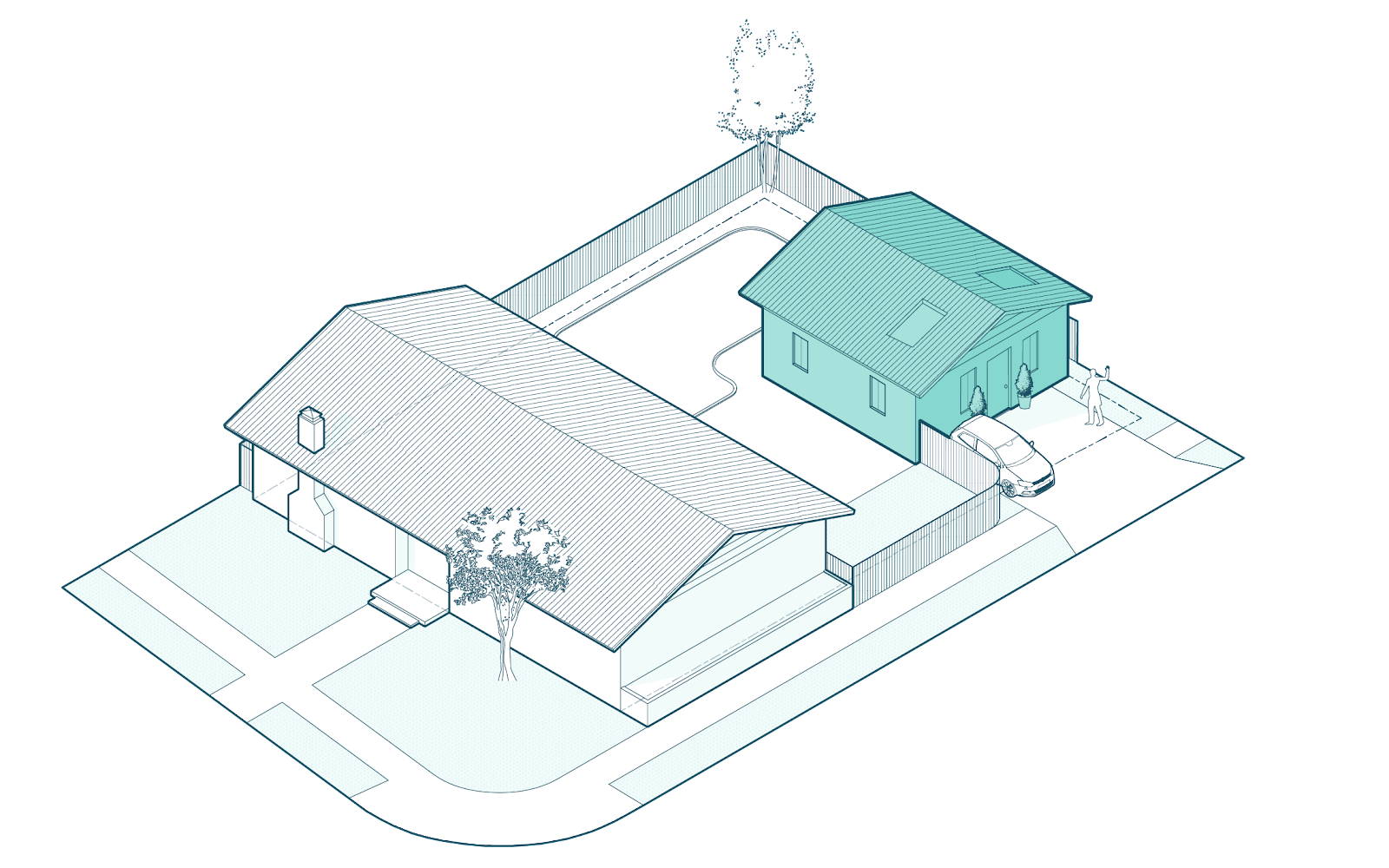

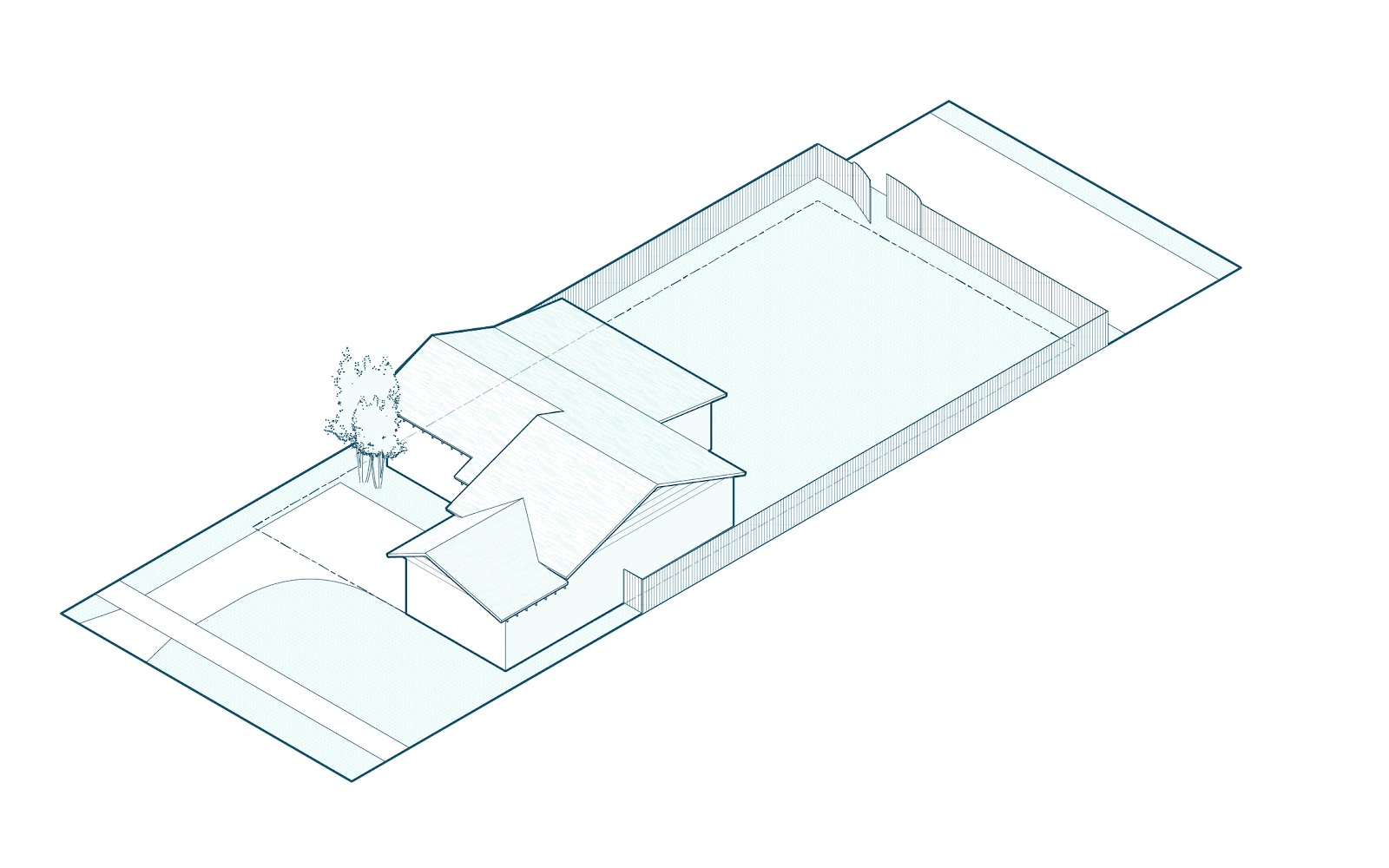

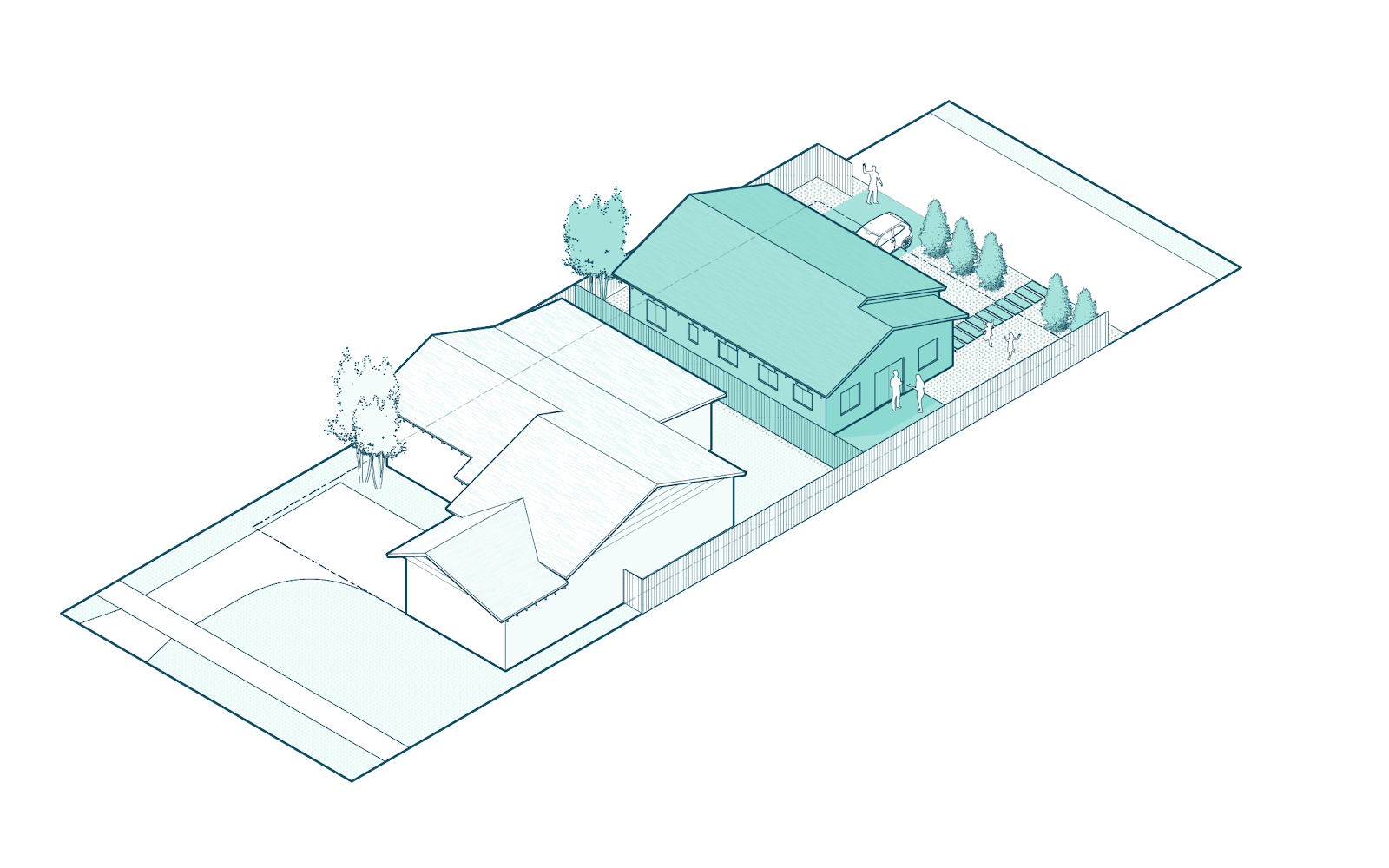

Detached ADUs

Detached ADUs may be up to 1,200 sq. ft. and are generally more spacious than other types. They also offer residents more privacy as they are completely separate from the main dwelling.

Let’s assume you’re building a 1,000 sq. ft. detached ADU. Assuming the statewide average value per square foot is approximately $600/sq. ft., your property value could increase by roughly $600,000!

Attached ADUs

The ADU ordinance imposes a size limit on units that are attached to the main dwelling. So, attached ADUs may not exceed 50% of the square footage of the existing home, meaning they generally have less habitable space than detached ADUs.

If your existing home is 1,200 sq. ft., then you may build a 600 sq. ft. attached ADU. This would add $360,000 to your property value as per the statewide average. While this is a significant increase, it is much less than what a detached dwelling could bring.

Conversion ADUs

Converting an existing space, such as a garage or a basement, can be less expensive than building an attached or detached ADU, but since conversion projects don’t add any square footage, they don’t boost property value by as much. Conversion projects make existing spaces habitable, but you will no longer be able to use that space for its original purpose.

Renting Out Your ADU

Renting out your ADU is a great way to earn passive income. Here’s what you stand to gain from short-term rentals (STRs) and long-term rentals (LTRs)

Short-term rentals

STRs, through platforms like Airbnb, have increased in popularity over the last few years. If you’re situated in a tourist destination or other popular area, you’ll likely be able to find renters with no problem. You might be able to charge a higher per-night fee depending on your ADU’s amenities, size, and exact location. Keep in mind, however, that there are local municipality regulations that govern short-term rentals.

Long-term rentals

If your designated municipality has a short-term rental ban, you can turn to long-term rentals (more than 31 days) as a way to earn passive income. Long-term rentals have some benefits; they don’t need cleanings and maintenance as frequently, and are easier to manage. Homeowners can also choose whether they’d like to rent out their primary residence or their ADU and temporarily live out of either dwelling.

How Much Rental Income Can You Earn With an ADU?

While the exact figure can vary based on size and location, you can earn thousands a month and recover construction costs in no time. Here’s a quick breakdown of your earning potential:

San Francisco

- Studio/one bedroom ADUs across the Bay Area typically list for roughly $2,400-$3,000 a month

- Two bedroom ADUs can be rented out for around $2,800 a month

- Larger, three bedroom ADUs could bring in upwards of $3,000 a month

Los Angeles

- Smaller ADUs (such as conversion projects under 400 sq. ft.) can be rented out for $1,200-$2,500 a month

- Mid-sized ADUs (under 800 sq. ft.) can bring you $1,400-$4,500 a month

- Larger ADUs (between 800 and 1,200 sq. ft.) may fetch anywhere from $2,400-$5,000 a month

San Diego

- Smaller/studio ADUs may earn you $1,600-$2,600 a month

- Two bedroom ADUs (in some areas of North County) have the potential to bring in $4,000 a month

- Larger ADUs (typically with three bedrooms) may bring in $2,700-$5,750 a month

As a general rule of thumb, you can estimate a yearly rental income of 1/7th of your total project cost. Let’s assume the cost of building a two bedroom ADU adds up to $200,000, inclusive of permits and other admin fees. Depending on your location and the size of your ADU, there is the potential to earn approximately $2,400/month in rent. You may be able to charge more in rent if you are situated in an area with higher rents. You can always check local rental listings to see what current rents are in your area.

Apart from rentals, ADUs can be used for many purposes, so take a look at some of the projects we’ve made happen and how they’ve boosted property value.

Berkeley Age-In-Place: $600k+ ADU Value

.webp)

This Berkeley 3 bedroom home plus detached studio ADU was listed at $1.495MM, but then sold for almost 50% over the asking price at $2.2MM after entering into contract just 4 days after the initial listing. Cottage’s estimate puts the ADU’s value at over $600k—and that’s even with generous price per square foot costs for comparable main houses in the 94703 zipcode.

While the detached ADU was once a two-car garage, the new ADU has an airy, craftsman style with a beautiful vaulted ceiling and exposed rafter beams on the interior. Originally built for the homeowners to age-in-place, the 430 sq. ft. ADU features a loft and skylights for a luxurious feel.

- Before ADU size: 1,681 sq. ft. (3BD/1.5BA)

- ADU size: 430 sq. ft. (1BD/1BA)

- Avg. comparable sale price of main home: $1,576,778 at $938 / sq. ft.

- Actual sale price: $2,200,000

- Estimated ADU value: $623,000

Like many other San Francisco Bay Area cities, Berkeley is facing a housing crunch that continues to drive home prices up. Adding an ADU is a win-win for everyone: it's a huge boost to your property value and rental income potential, and a new housing unit for a state that sorely needs it.

San Jose Detached ADU Adds $500K in Value

.webp)

Right off the bat, the numbers behind this single family home plus ADU are stunning. This ADU was massive; at 1,121 sq. ft. it’s actually larger than the main house!

But that’s fair game in ADU-friendly San Jose, and no wonder—the ADU added almost $500K in value to the property, which was sold in June 2021.

- Before ADU size: 1,008 sq. ft. (2BR/1BA)

- ADU size: 1,121 sq. ft. (2BR/1BA)

- Avg. comparable sale price for main home: $1,015,792 at $1,007 / sq. ft.

- Actual sale price: $1,512,000

- Estimated ADU value: $496,000

San Jose has seen an explosion of ADU unit construction, with over 700 permitted in 2019 and 2020 alone. With homeowners unlocking value like this, we’re expecting a continued increase in ADUs permitted in San Jose.

Los Angeles Craftsman Classic Adds $240,000+ in ADU Value

.webp)

Even more than the San Francisco Bay Area, Los Angeles has seen an explosion of ADU construction, with over 19,000 ADU permit applications since 2015 and over 13,600 either built or under construction as of August 2021.

This Sherman Oaks craftsman classic is representative of many San Fernando Valley homes. The main house was recently updated, putting it on the upper end of price per sq. ft. for 2021 home sales in the area. Even with the remodel adding to its premium price, the ADU still increased the property's value by almost $250K.

- Before ADU size: 1,130 sq. ft. (3BD/2BA)

- ADU size: ADU Size: 477 sq. ft. (1BD/1BA)

- Avg. comparable sale price of main home: $1,045,250 at $925 / sq. ft.

- Actual sale price: $1,289,500

- Estimated ADU value: $244,000

If you're a Los Angeles homeowner interested in learning more about how to unlock your property’s full value, book a time to speak with us today! Cottage has pre-approved plans for 1-bedroom and 2-bedroom ADUs in the City of Los Angeles’ ADU Standard Plan Pre-approval Program, making it even more affordable and faster to build your LA ADU.

Add Instant Value to Your Property With a Cottage ADU

There has never been a better time to build an ADU for homeowners that have the backyard area or a convertible space and can finance an ADU with a loan or savings on hand. And with Cottage here to help you through each stage of the ADU journey, it’s never been easier to build your ADU now.

Click here to book a free consultation and estimate with a Cottage ADU expert!

FAQs

Is an ADU a good investment?

Yes, it is a reliable long-term investment. Not only does it add value to your property, but you can rent out your ADU and earn passive income.

What is the ROI on an ADU?

While the exact ROI would depend on local rental markets, total construction costs and project financing, the addition of an ADU contributes significantly to the long-term value of your home. On average, an ADU may bring you an ROI of 5-10%. Short-term rental income may also help to offset building costs!

Is ADU square footage counted in a property appraisal?

Attached ADUs can be included in the Gross Living Area of the primary dwelling, but detached ADUs must be appraised separately.

How much value does a garage conversion ADU add?

In many cases, garage square footage is not included in your home’s appraised square footage. In these cases, a garage conversion ADU will add value to your home by adding square footage. If an existing garage is included in your home’s existing square footage, the garage conversion ADU will likely add less value than a detached or attached ADU. Conversion ADUs can earn you $1,500-3,000 in monthly rental income.

What are the tax benefits of an ADU in California?

Your whole property won’t be reassessed in value—your ADU will be assessed on its own, so your property taxes won’t increase by a lot.

You can expect to pay about 1-1.5% of your ADU build cost in property tax. For example, if you spent $400,000 to construct your ADU, you might pay an additional $4,000 - $6,000 in property tax per year.